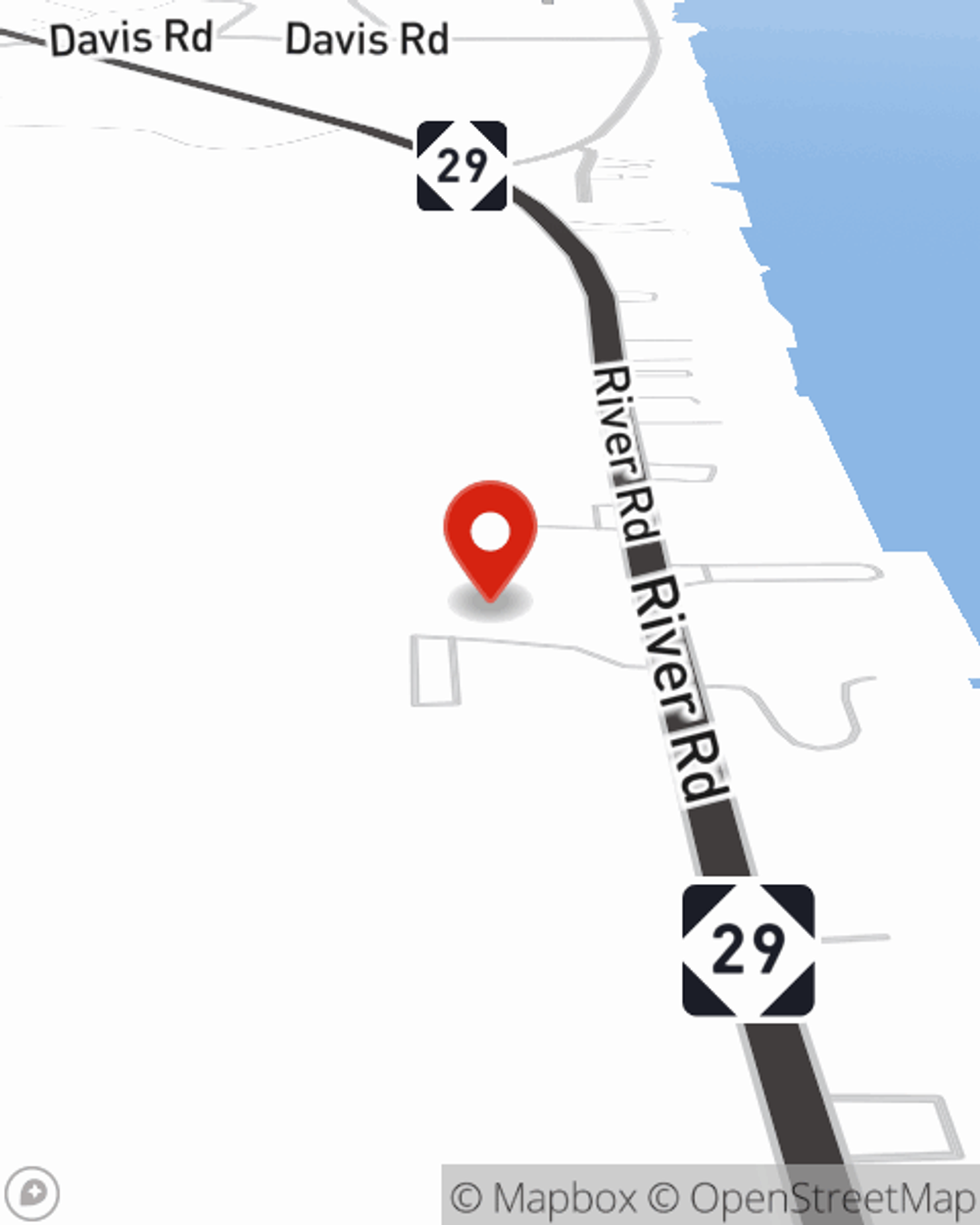

Condo Insurance in and around Saint Clair

Get your Saint Clair condo insured right here!

Quality coverage for your condo and belongings inside

- Port Huron

- Marine City

- Marysville, MI

- Algonac

- Fort Gratiot, MI

- St. Clair County

- Michigan

- Wadhams

- South East Michigan

- Lapeer

- Imlay City, MI

Your Search For Condo Insurance Ends With State Farm

The life you treasure is rooted in the condo you call home. Your condo is where you catch your breath, wind down and kick back. It’s where you build a life with family and friends.

Get your Saint Clair condo insured right here!

Quality coverage for your condo and belongings inside

Condo Unitowners Insurance You Can Count On

That’s why you need State Farm Condo Unitowners Insurance. Agent Zach Eagen can roll out the welcome mat to help provide you with coverage for your particular situation. You’ll feel right at home with Agent Zach Eagen, with a hassle-free experience to get dependable coverage for your condo unitowners insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Agent Zach Eagen can help you file your claim whenever life goes wrong. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Contact Zach Eagen's office today to see how you can meet your needs with Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Zach at (810) 637-5010 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.